Inbound Real Estate Transactions

We have more than ten years of experience in supporting foreign companies with real estate investments in Germany.

We have in-depth knowledge of the financing, organization and business challenges associated with investments in German real estate.

We support our clients in

- domestic tax issues within the scope of the German limited tax liability;

- optimization of the interaction between owners, asset managers, property managers, local accounting firms, local domiciliation service providers, auditors and German tax authorities as well as

- due diligence in the acquisition and sale of companies and real estate.

In addition, we have extensive experience in assisting Luxembourg companies with

- accounting for German and Luxembourg tax purposes including optimization for Luxembourg commercial law purposes,

- preparation of annual financial statements in accordance with Luxembourg GAAP,

- preparation of other documents subject to disclosure requirements in Luxembourg (PCN, resolutions) and

- assisting Luxembourg tax advisors in fulfilling their Luxembourg tax obligations.

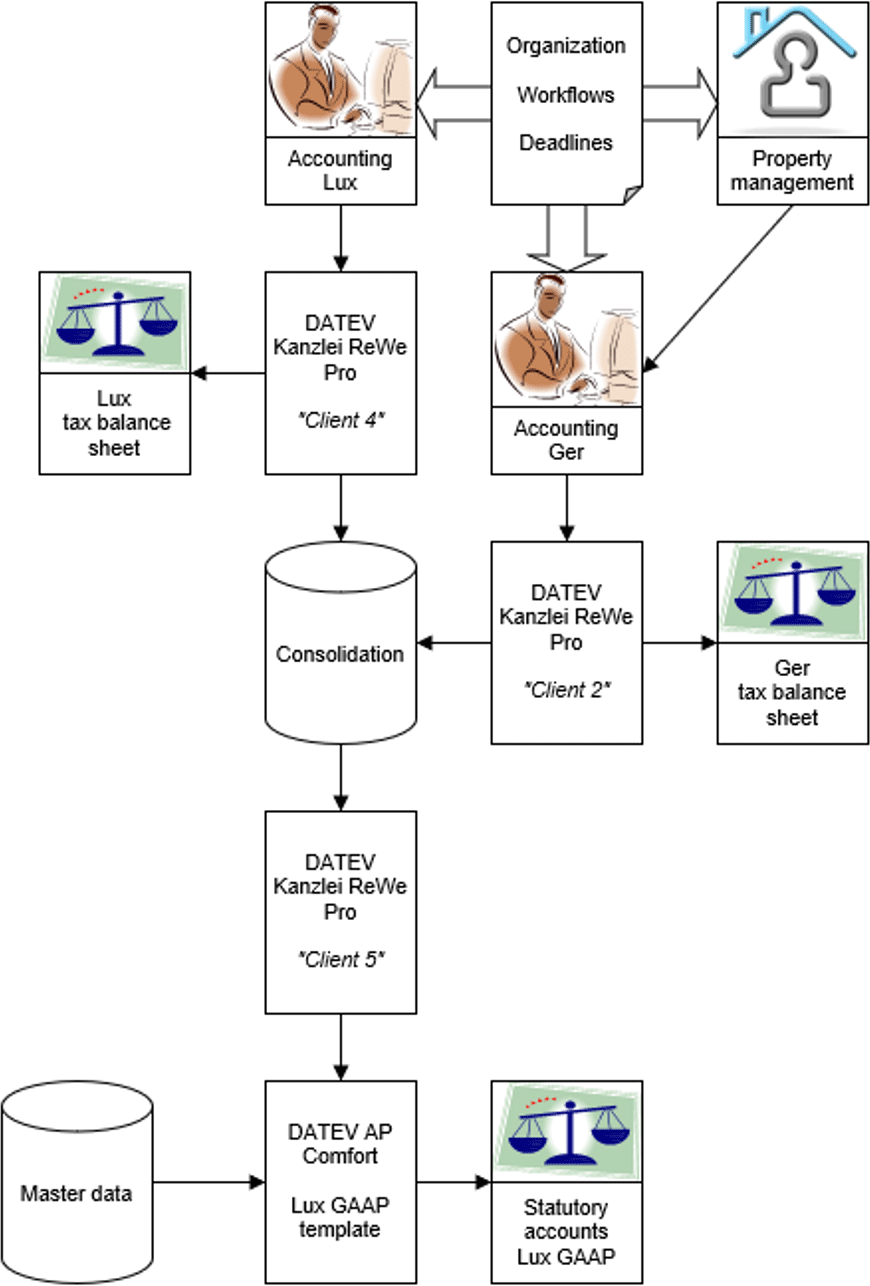

We have developed special tools and templates partly in DATEV for this purpose.

An example for the implementation of an accounting system for a Luxembourg investment company: